Create a Winning Portfolio

Learn the secrets to the stock selection strategy

of the greatest investor of all time.

If you want to live on the beach like Jimmy Buffett once did,

then you've got to learn how to invest better than Warren Buffett does now.

Instructional Videos ...

INTRODUCTION - WHAT IS CLEAN SURPLUS?

THE COMPLETE SCIENCE OF THE GREATEST STOCK SELECTION METHOD EVER

PORTFOLIO INSURANCE

INTRODUCTION TO THE ETF DATABASE

GET YOUR COPY OF THE BOOK

RESEARCH & RESULTS

ABOUT DR. JOSEPH BELMONTE

INTRODUCTION - WHAT IS CLEAN SURPLUS?

WHAT IS CLEAN SURPLUS?

Clean Surplus is a little known accounting method designed to provide predictability for the investor. It is an extremely accurate method that allows us to compare the operating efficiency of each and every company in the exact same manner.

The traditional accounting statements do not develop the book value (Owners’ Equity) in the same manner for any two companies. Clean Surplus does indeed allow the exact, identical development of book value (Owners’ Equity) for each and every company. Thus, the efficiency ratio, Return on Equity developed by Clean Surplus and only Clean Surplus can be used as a true, comparable equivalent.

The accounting profession was aware that the traditional income statement didn’t provide for predictability and neither did the balance sheet. This is why Clean Surplus was developed. The problem is Clean Surplus has never been tested until now, and thus has not been used except by a very few, extremely successful people such as Warren Buffett.

The diminutive amount of research work on Clean Surplus prior to Dr. Belmonte’s research attempts to use Clean Surplus as a discounting valuation model. However, as with all discounting valuation models, we know by the failure of 96% of money managers (public mutual funds) to consistently outperform the averages over a 10-year time period, that these models just don’t work very well.

Buffett uses Clean Surplus to develop a Clean Surplus Return on Equity (ROE) rather than using the traditional accounting ROE as a comparison ratio in order to assess the consistency of the operating efficiency of a company and also the level of that operating efficiency.

Dr. Belmonte uses the Clean Surplus ROE to construct portfolios “predicted” to consistently outperform the market averages. Dr. Belmonte statistically measures the effectiveness of predictability using Clean Surplus over the past 15 years and finds that no other research and/or practical application can approach the success that he finds with the application of Clean Surplus.

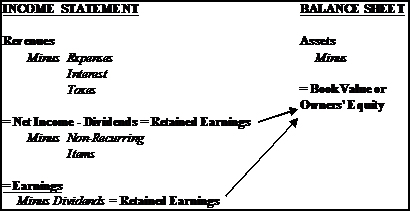

Traditional accounting constructs the ROE by using Earnings from the income statement divided by Book Value (Owners’ Equity) from the accounting balance sheet. See the bottom arrow on the chart.

Clean Surplus instead uses Net Income from operations as the “Return” portion of the ROE and then constructs its own Owners’ Equity as the “Equity” portion of ROE. This is the top arrow on the chart.

Of course, Net Income minus Dividends (top arrow) will net a different Owners’ Equity than will Earnings minus Dividends. It is this new calculation of Owners’ Equity (Net Income minus Dividends) that allows a truly comparable Return on Equity ratio to be developed. And it is this comparable Return on Equity ratio that is the foundation of the success of Clean Surplus.

Clean Surplus allows a true comparison of ROE (operating efficiency) from one company to another while traditional accounting does not allow for good or even mediocre comparability.

Dr. Belmonte’s research attempts to statistically answer two questions:

1) Do portfolios with above average Clean Surplus ROEs outperform the market averages and 2) Does the Clean Surplus ROE (the percentage number) have any correlation with the future returns of portfolios?

The results of the research show that indeed, the answers to both questions are yes. Not only do every one of the portfolios predicted to outperform the averages do so, but there is a strong correlation as to how much those portfolios will return. Correlations of ROE and the future total returns with portfolios of 30 stocks averaged consistently between 79% to 80%.

Create a Winning Portfolio

Portfolio Insurance

INTRODUCTION TO THE ETF DATABASE

DOWNLOAD THE PDF BOOK

Construct a portfolio that outperforms market averages

Warren Buffett had it right all along. Now it's your turn to learn how to construct a portfolio that is sure to outperform the market averages, as well as almost every professional money manager in the world.

Warren Buffett's method of predictability can determine a future target price, which in turn determines his all-important purchase price. However, Buffett doesn't draw conclusions of his predictability method relative to the future total returns of portfolios.

That's where Buffett and Beyond comes in, taking Buffett's method one giant step beyond, proving that if you select a portfolio of stocks using the predictability method in this book, you will outperform 96% of professional money managers over the long term.

- Explains Clean Surplus Accounting (CSA) to determine Return on Owners' Equity (ROE)

- Uses CSA to determine ROE in a unique way to verify Buffett's all-important purchase price

- Draws conclusions between Clean Surplus Return on Equity and future total returns

- Shows that every portfolio selected from the S&P 500 index with above-average Clean Surplus ROEs outperformed the S&P average during the test periods from 1987 to the present

If you're an investor, this book will impact your financial life forever.

DOWNLOAD PDF BOOK NOWResearch & Results...

MODEL PORTFOLIO RESULTS:

Growth Portfolio

Since 12/31/2002

Growth Portfolio —————— 1,292%

S&P 500 Index ———————-440%

Compounded Yearly Returns

Growth Portfolio ——————–61.5%

Dow Industrials ———————20.9%

Note: Yearly compounded return

ORIGINAL PUBLISHED RESEARCH RESULTS

The original research on the S&P 500 stocks for the years 1990 through 1998 was first made available to the academic community through Dr. Joseph Belmonte’s Doctoral Dissertation in 2002 and then to the investment community through his book entitled Buffett and Beyond published in 2004 under his penname of Dr. J.B. Farwell. This first edition was so successful that the second edition of Buffett and Beyond was published in 2015 by Wiley Publishing.

Please be aware that when Return on Equity (ROE) is used in any of our material, it is NOT the Traditional Accounting ROE, but rather the Clean Surplus ROE. Please see above “What is Clean Surplus.”

ALL TEST PERIODS

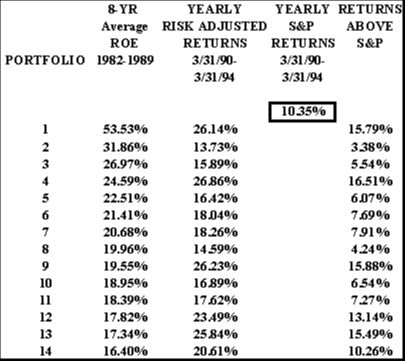

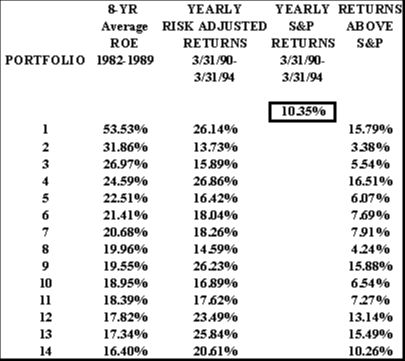

Below are the portfolio results of the first of three, 4-year test periods. Each of the results shown include fourteen portfolios all of which had an average portfolio Clean Surplus ROE greater than the average Clean Surplus ROE of all the S&P 500 stocks in the test. In other words, they are portfolios with above-average ROEs.

RESULTS: FIRST TEST PERIOD

Each individual portfolio’s average ROE (the average of the ROEs of all the stocks in each portfolio) from 1982 through 1989 is followed by the risk-adjusted average per year return for the following 4 years.

The S&P returned 10.35% per year during this 4-year time frame. Every one of the portfolios with above average ROEs outperformed the S&P 500 Index for the 4 year period of 3/31/1990 through 3/31/1994.

MODEL PORTFOLIO RESULTS

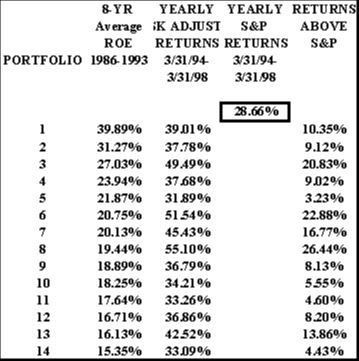

RESULTS: SECOND TEST PERIOD

The results of the second test period are below. Each portfolio’s 8-year average ROE from 1986 through 1993 is followed by the risk-adjusted average per year return of March end 1994 through March end 1998.

The S&P returned 28.66% per year during this time frame. Every one of the portfolios with above average ROEs outperformed the S&P 500 for the period 3/31/1994 through 3/31/1998.

RESULTS: THIRD TEST PERIOD

The results during this bear market are the same as the first two test periods. Every 10-stock portfolio with above average Clean Surplus ROEs outperformed the market averages over the following 4-year time periods.

All Portfolios with above average ROEs outperformed the S&P 500 Index for the period 12/31/1998 through 12/31/2002.

BENEFITS OF LARGER PORTFOLIOS: MUCH GREATER PREDICTABILITY (AND SAFETY) OVER ALL TIME PERIODS

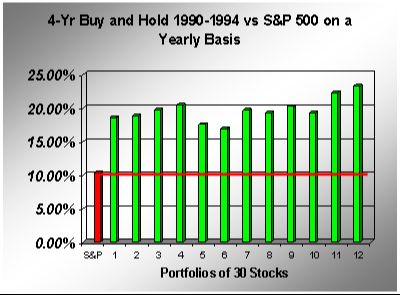

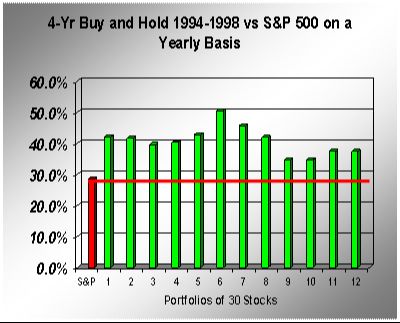

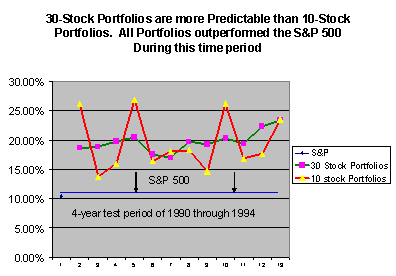

This chart shows the first 4-year test period. However, all the test periods result in the same chart formation. In every case, portfolios constructed of 30 stocks are much more predictable (in their total returns) than portfolios of just 10 stocks. However, in both portfolio sizes, 10 stocks and 30 stocks, all portfolios outperformed the S&P 500 index over all test periods.

This chart shows the first 4-year test period. However, all the test periods result in the same chart formation. In every case, portfolios constructed of 30 stocks are much more predictable (in their total returns) than portfolios of just 10 stocks. However, in both portfolio sizes, 10 stocks and 30 stocks, all portfolios outperformed the S&P 500 index over all test periods.

The meaning of this is extraordinary. As an example, if a portfolio of 30 stocks exhibits an average ROE of 25%, we would expect an 80% chance that this portfolio will return approximately 20% (25% x 80%) in an average year when the S&P returns 12%.

This chart is a culmination of four, 4-year test periods 3 of which were shown above. The percentages you see, such as 1990-1993 show the Clean Surplus portfolio exceeding the S&P 500 index by and average of 18.6% – 10.4% or 8.2% PER YEAR for each of the 4 years that the portfolio was held.

This chart is a culmination of four, 4-year test periods 3 of which were shown above. The percentages you see, such as 1990-1993 show the Clean Surplus portfolio exceeding the S&P 500 index by and average of 18.6% – 10.4% or 8.2% PER YEAR for each of the 4 years that the portfolio was held.

SUMMARY: THE FINAL TEST RESULTS

The results of all test periods as well as the up-to-date research in the very beginning of this link, shows that every portfolio which was predicted to outperform the S&P index did indeed do so whether the holding period was a one year (recent research) or a four year holding period. These results indicate that Clean Surplus does indeed exhibit PREDICTABILITY and portfolios with a high and consistent Clean Surplus Return on Equity outperform portfolios with lower and inconsistent ROEs.

NICE TO MEET YOU

I'm Joseph Belmonte

I developed the “Buffett and Beyond” investment method when I was researching and completing my Doctoral Dissertation on Clean Surplus Accounting (CSA) in the late 1990's. Here is what I found ...

Buffett…

I learned that Warren Buffett, the famed chairman of Berkshire Hathaway and legendary investor, used Clean Surplus Accounting (CSA) in his calculations to determine Return on Owners’ Equity (ROE). Rather than using the traditional accounting numbers, Buffett used CSA in order to determine his all important purchase price. However, he did not draw any conclusions between Clean Surplus ROE and future total returns.

…and Beyond

I discovered that that when I selected test portfolios with above-average Clean Surplus ROEs, the test portfolio returns consistently outperformed the S&P 500 average during test periods from 1987 to the present.

Getting the Message Out to Help Individual Investors and Money Managers

Since completing my doctorate in Business Administration with a specialty in Finance, I have taught investments, corporate finance and advanced managerial finance for many years, both in the state university system and also in private universities throughout the state of Florida. In addition, I have lectured to numerous professional and investment groups across the country, have written many articles and published a book "Buffett and Beyond."

I have developed several nationally sanctioned courses for Investors, Certified Public Accountants, Financial Planners and professional money managers. The courses for CPAs have been approved for continuing education credits in over 38 states.

I developed a user-friendly computer program for professionals and serious investors to use in these courses. One course won acclaim from a national brokerage training school.

My weekly video newsletter is sent to thousands of investors, money managers and academics both nationally and internationally.

... about the Investment Method

“An excellent approach to developing predictability and a successful portfolio. The results certainly speak for themselves. I just wish I would have known about this method of stock selection 20 years ago because I would have been richer than Buffett himself.

- M.D. CPA, Miami, Florida.

...about the training

I’ve been to every training ever given. This training has raised the bar to a new height and sets a standard that can only be dreamed about by other lecturers.”

- Retired Money Manager,

Delray Beach, Florida

... about the book

Dr. Belmonte’s book will set a new standard for investing. The Clean Surplus method must be used by anyone expecting to consistently beat the averages.

- S.H. CFP, RIA, Ocean Ridge, Florida